A Retail and Health Plan Partnership Can Improve Outcomes

By: John Reynolds, Ph.D. – President, Sunny Benefits

Sunny's partnership with Costco marks a groundbreaking shift in how Medicare Advantage Plan members use their supplemental benefits. By providing access to Costco's wide range of products and services—such as food, fuel, and health essentials—Sunny is simplifying the healthcare experience while delivering meaningful savings. A partnership with the right retailer can help stretch member dollars while positively impacting member satisfaction and unit economics.

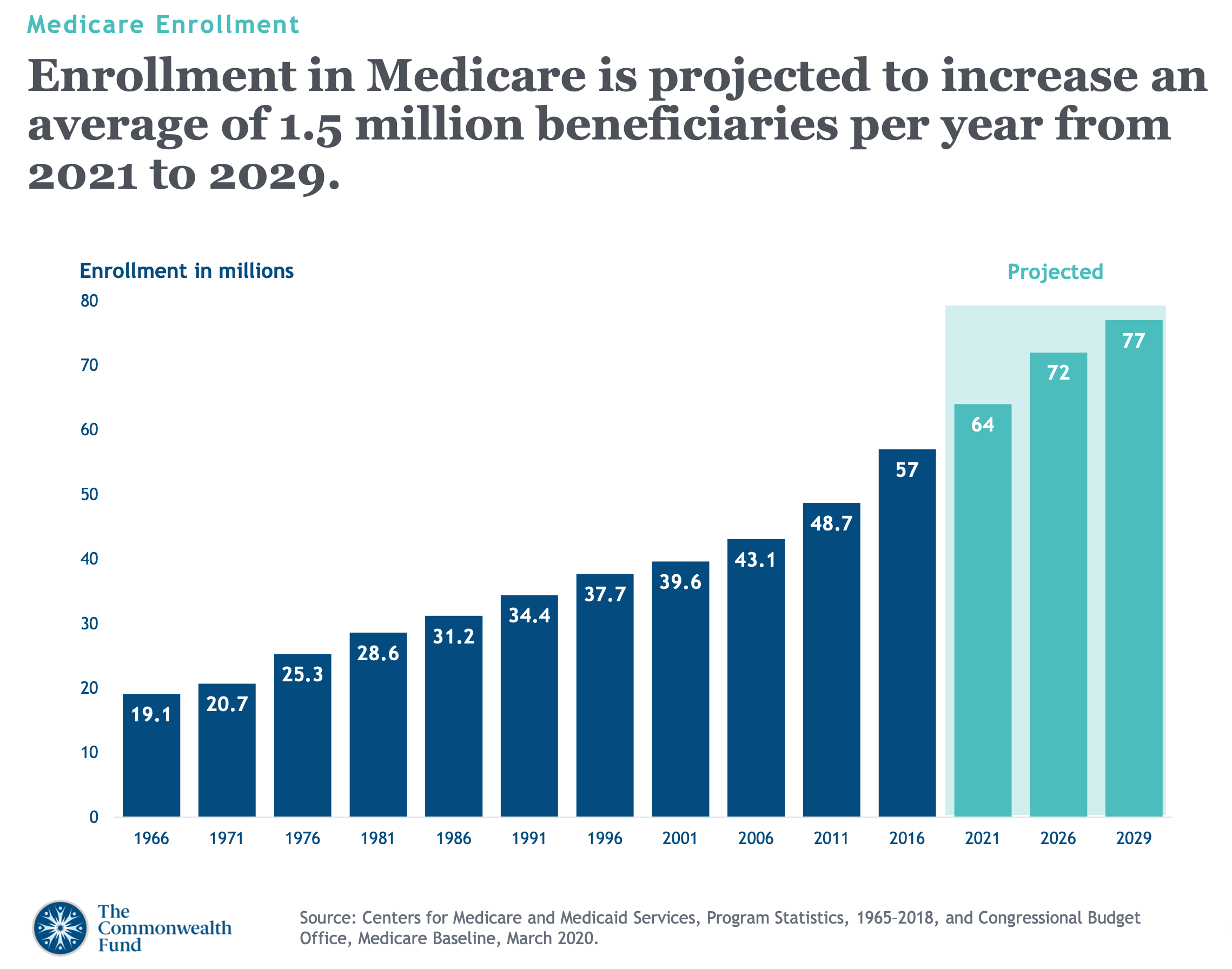

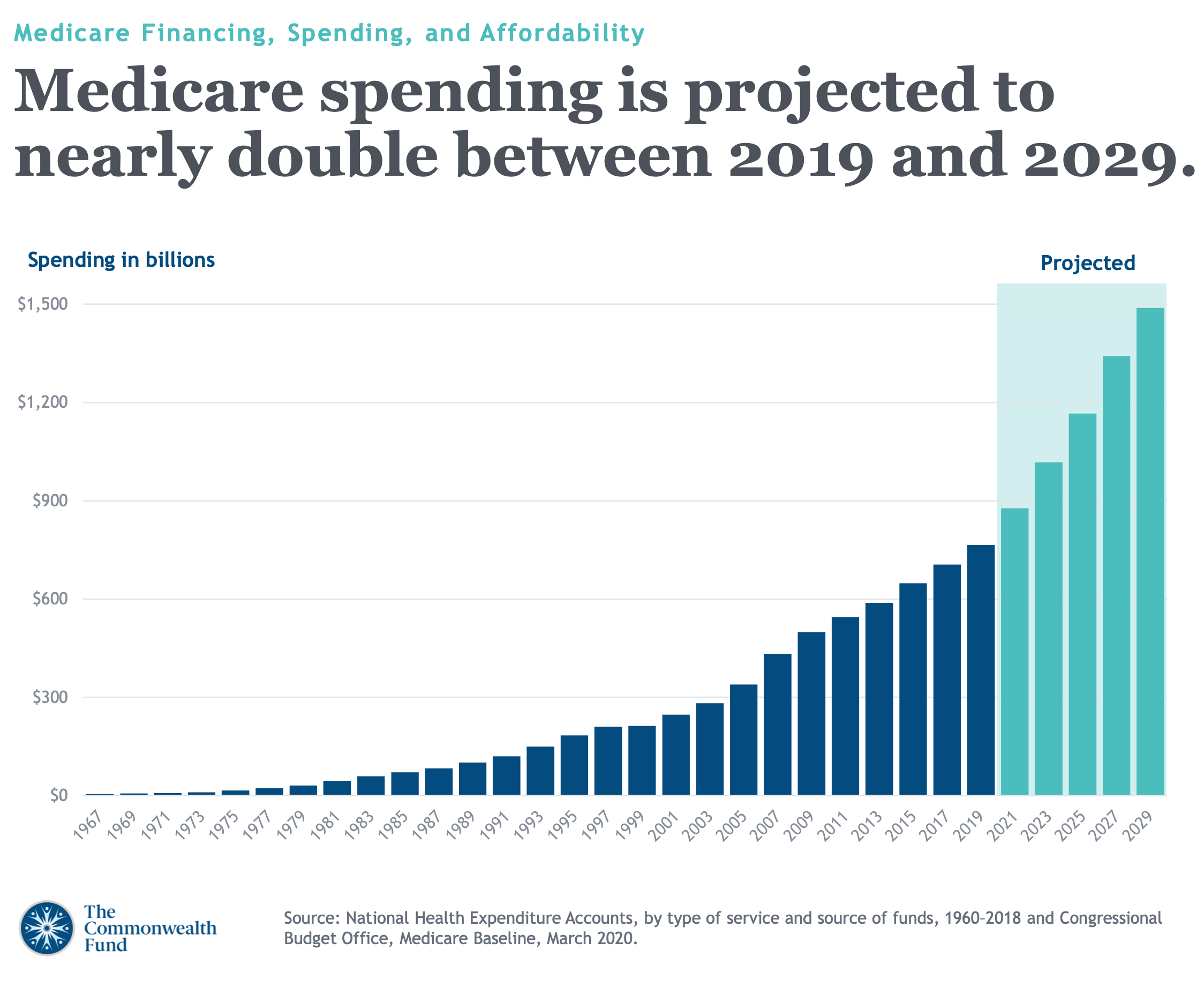

Differentiated supplemental benefit offerings will give payers an edge over Medicare Advantage marketplace competitors. Medicare Advantage enrollment will increase by 1.5 million beneficiaries annually from 2021 – 2029. However, Centers for Medicare and Medicaid Services (CMS) rate changes have created financial headwinds for payers. To thrive in this evolving marketplace and retain and grow membership, retailers and health plans must excel in responsible spending while improving population health. This can be achieved by providing beneficiaries with competitively priced supplemental benefit offerings for healthcare essentials, including food, Over-The-Counter, Vision, and hearing. Today’s marketplace exhibits a wide variation of pricing across top retailers in these categories, and the traditional Medicare Advantage beneficiary is price savvy, interested in stretching the value of each dollar and weighing the overall value between Medicare Advantage plans. This blog details the evolving marketplace and competitive considerations for your health plan and beneficiaries.

Medicare is a Growth Engine

Health plan revenue from the Medicare Advantage (MA) business grew more than threefold in the past decade, driven by enrollment growth fueled by an aging US population and increasing consumer preference toward MA (versus Medicare’s fee-for-service program) 1.

In the past decade, underwriting margins in MA have been consistently among the highest of all lines of business. The older adult population, especially those with higher care needs, has preferred supplemental benefits at higher premiums2.

Demographic Trends

The older adult population (65+) in the United States is expected to grow to about 73 million by 2030 and 95 million by 2060. In addition, older adults are increasingly opting to enroll in MA over traditional Medicare because it offers additional benefits and lower (i.e., better) out-of-pocket cost limits.

Rate Decreases

2025 will be the second straight year of rate decreases in MA. The base pay decrease results from the continued phase-in of changes to how regulators calculate risk adjustments, which is meant to make payments more accurate. (2) Payments from the government to MA plans are still expected to increase 3.7% on average in 2025 compared to this year, representing an increase of more than $16 billion in reimbursement after plans risk score their enrollees1.

Health Plan Unit Economics

Health plan unit economics are complex and dynamic. Unlike other industries, Health plan businesses must deal with multiple stakeholders, regulatory environments, and ethical issues that can impact their unit economics. Moreover, health plan unit economics are not static; they change over time as the business grows, innovates, and adapts to market conditions. Therefore, Health plans must constantly monitor and evaluate their unit economics and adjust their strategies accordingly.

Health plan unit economics are not the only metric that matters. While unit economics are essential for measuring Health plan businesses' financial viability and sustainability, they are not the only metric that matters. Health plans also need to consider other aspects such as the social impact, the clinical outcomes, the customer satisfaction, and the competitive advantage of their Health plan solutions. Finding ways to stretch Medicare Advantage members' supplemental benefits further by aligning with a high-value retail partner is one way to enhance member satisfaction, which impacts unit economics.

Retailer and Payer Partnerships

Over the past couple of years, it was predicted that major retail chains like Walmart, Walgreens, CVS, and Dollar General would expand into healthcare using their enormous consumer footprints in the U.S. to make primary care more available. However, in April, Walmart and its telehealth operations closed 51 healthcare centers. Walmart isn’t the only retailer reevaluating primary care ventures. Walgreens has announced plans to shutter 160 VillageMD locations after taking a $5.8 billion loss on the clinics. The recent developments by retail giants to pivot away from providing primary care do not diminish the opportunities for creative retailer and health plan partnerships. There remains an opportunity to leverage the retail footprint and inventory of Over-The-Counter (OTC), food, vision, and hearing items to drive improved health outcomes and stretch Medicare Advantage supplemental benefit dollars further.

Retail chains and health plans collect massive amounts of data about their customers. For food-as-medicine programs, data exchange could allow prescriptions to be filled automatically and delivered to a patient’s home by a retailer’s store-to-door delivery service.

How can Payers Drive Value through a Partnership?

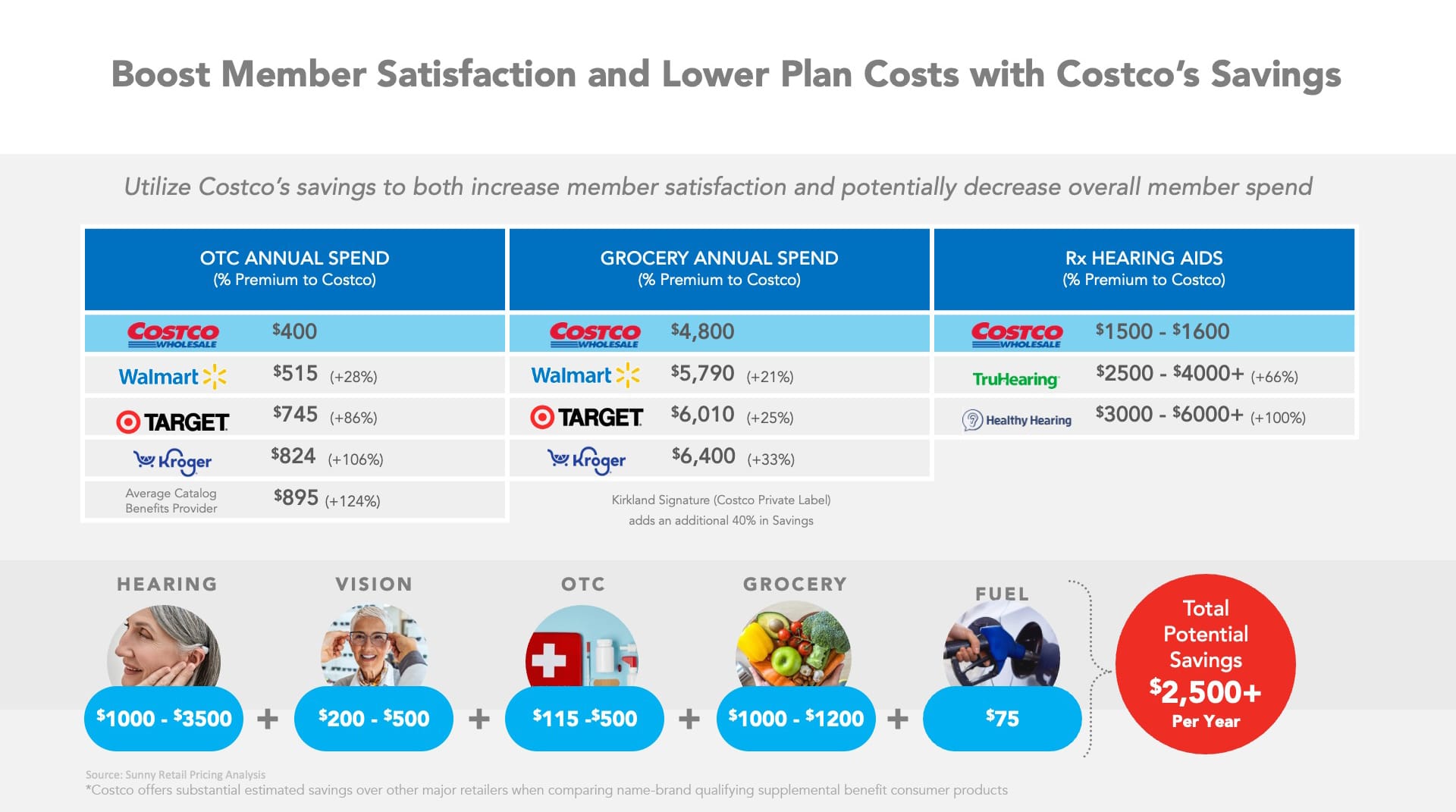

To move toward a successful model, retailers and health plans must focus on helping members manage spending while improving population health. In reviewing large retailers and the ability to satisfy member needs for broad healthcare essentials (food, OTC, vision, and hearing), there are significant differences in price for like items, as indicated in the graphic below. For example, Costco offers substantial estimated savings over other major retailers when comparing name-brand qualifying supplemental benefit consumer products, as depicted in the table below. The savings appeal to beneficiaries and increase the likelihood of benefit utilization.

Seniors Shop at Costco

Research shows that individuals on a fixed income have a mindset to stretch their dollar and take advantage of “found money,” which is any opportunity that presents the senior with actual savings, credits, cash, or cash equivalents. The concept of actual savings is essential. Seniors are generally price savvy. Offering a discount off an uncompetitive retail price or providing credits for goods and services that are “marked-up” result in the senior “devaluing” the Health Plan’s offering.

Costco is trusted by seniors because it stretches the seniors' hard-earned dollar with pricing that is consistently lower than major competitors like Walmart. It is even more competitive, when you include its highly regarded private label, the “Kirkland” brand.

Seniors buy many items in bulk to take advantage of Costco savings (Pet food, paper products, shelf-stable foods, personal care items, etc.). They also buy meat and other perishables that can be frozen.

Costco is a Destination for Health

Costco allows seniors access to pharmacists to discuss medications, and other health-related topics. Their pharmacy pricing is more competitive than many large pharmacy retailers. In addition, Costco offers Over-The-Counter (OTC), durable medical equipment (DME), and other non-prescription healthcare products, representing up to 50% savings over most competitor Flex card programs where OTC carries a significant markup. In addition to pharmacy offerings, Costco has a substantial footprint in hearing aids and eyeglass sales and sells more hearing aids than any other retailer and has achieved #2 marketshare in eyeglass sales, just behind Walmart.

How Can a Sunny Partnership Accelerate Your Path to Success?

• The ability to increase member satisfaction and retention by helping seniors stretch their dollars through its partnership with Costco.

• Ensuring seniors are getting access to “real savings.”

• Improved STARS ratings through an overall improved member experience with leading-edge digital tools, a single benefit and reward Sunny Visa® Prepaid Card, a partnership with Costco, and nudges provided through the Sunny application.

• Transparent reporting and analytics help the Health Plan determine the most appropriate program structure.

Let’s start with a bold solution built by experts to fuel your success.

At Sunny, we pride ourselves on our commitment to innovation and customer-centric solutions. Our digital-first approach ensures that we cater to all members' needs while embracing the latest technology to enhance their experience. By designing our solution from the ground up with seniors in mind, we’re revolutionizing how supplemental benefits are delivered in the Medicare Advantage landscape. Sunny is built on a modern, agile technology that creates streamlined experiences for all who interact with it. Sunny’s solution enables payers to compete and win with lower costs and more innovation against larger companies. Our partnership with Costco is an excellent example of how we can increase value for Medicare members.

Sunny partners with payers like you to provide a digital-first, mobile-enabled benefit and rewards solution that improves the overall consumer experience, drives positive health outcomes, and reduces cost.

Resources: https://www.sunnybenefits.com

About the Author:

John Reynolds, Ph.D., has over 30 years of experience in healthcare services, benefits consulting, and financial technology. He is currently the President of Sunny Benefits. Most recently, Reynolds was president of Solutran, a division of UnitedHealth Group (Optum). Previously, he was President of FIS (Fidelity National Information Services, NYSE: FIS) Healthcare, Government, and Biller Solutions.

Reynolds is an Adjunct Professor at the University of Minnesota, teaching Healthcare Services Leadership. Previously, he was an adjunct professor at St.Catherine’s University, teaching healthcare economics and policy in their Masters of Business Administration (MBA) program. He has frequently spoken at national healthcare and financial services conferences, published numerous articles on consumer-directed healthcare, and co-authored the book, “Overdose: Your Health, My Money,” which explains the Affordable Care Act and its ramifications for the American public.

John Reynolds holds a Bachelor of Science in Economics from the University of Minnesota. He also has a Master’s in Management and Administration and earned his Ph.D. in Business, Organization, and Management.

- Andy Davis, Jeff Burke, How Peng Zhir, Hemnabn Varia, “In a shifting market, it is “advantage” Medicare for health plans,” Deloitte Insights, July 25, 2023. https://www2.deloitte.com/us/en/insights/industry/health-care/health-insurance-trends.html/#endnote-15

- Christina Ramsay, Gretchen Jacobson, Steven Findlay, and Aimee Cicciello, “Medicare Advantage: A Policy Primer, 2024 Update” (explainer), Commonwealth Fund, Jan. 31, 2024. https://doi.org/10.26099/69fq-dy83

The Sunny Visa® Prepaid Card is issued by The Bancorp Bank, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may not be used everywhere Visa debit cards are accepted.

Disclaimer: Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).